The columnist Matt Yglesias, who just spent time in Argentina, recently wrote in Slate about the lessons of that country’s recovery following its exit from the one-peso-one-dollar “convertibility law.” As he says, it’s a remarkable success story, and one that arguably holds lessons for the euro zone.

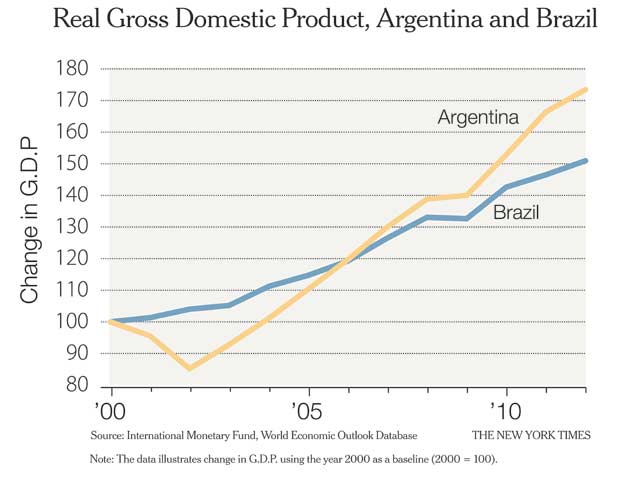

“Default and devaluation were hardly a party. They destroyed the country’s banking system and wiped out many Argentines’ savings,” Mr. Yglesias wrote on May 1. “But it did work. Argentina has grown rapidly in subsequent years and its unemployment rate has fallen steadily to 6.7 percent, a rate we envy in the United States.”

I’d just add something else: press coverage of Argentina is another one of those examples of how conventional wisdom can apparently make it impossible to get basic facts right. We keep getting stories about Ireland’s recovery when there is, in fact, no recovery — but there should be, darn it, because they’ve done the “right” thing, so that’s what we’ll report.

And conversely, articles about Argentina are almost always very negative in tone — they’re irresponsible, they’re renationalizing some industries, they talk populist, so things must be going very badly. Never mind the data, shown on this page.

Just to be clear, I think Brazil is going pretty well, and has had good leadership. But why exactly is Brazil an impressive B.R.I.C. while Argentina is always disparaged?

Actually, we know why — but it doesn’t speak well for the state of economics reporting.

Don’t Know Much About (Ancient) History

The things I do for book sales. I debated, sort of, Ron Paul on Bloomberg TV recently (it can be seen online at bloomberg.com/video).

I thought we might have a discussion about why the runaway inflation he and his allies keep predicting keeps not happening. But no, he insisted (if I understood him correctly) that currency debasement and price controls destroyed the Roman Empire. I responded that I am not a defender of the economic policies of the Emperor Diocletian.

Actually, though, appeals to what supposedly happened somewhere in the distant past are quite common on the goldbug side of economics. And it’s kind of telling.

I mean, history is essential to economic analysis. You really do want to know, say, about the failure of Argentina’s convertibility law, of the effects of Chancellor Brüning’s dedication to the gold standard in Germany, and many other episodes.

Somehow, though, people like Mr. Paul don’t like to talk about events of the past century, for which we have reasonably good data; they like to talk about events in the dim mists of history, where we don’t really know what happened. And I think that’s no accident. Partly it’s the attempt of the autodidact to show off his esoteric knowledge; but it’s also because we don’t really know what happened — what really did go down during the Diocletian era? — so you can project what you think should have happened onto the sketchy record, then claim vindication for whatever you want to believe.

It’s funny, in a way — except that this sort of thinking dominates one of our two main political parties.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $41,000 in the next 5 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.