(Image: CLEMENT, Canada / CartoonArts International / The New York Times Syndicate)These past few years have been lean times in many respects — but they’ve been boom years for agonizingly dumb, pound-your-head-on-the-table economic fallacies.

(Image: CLEMENT, Canada / CartoonArts International / The New York Times Syndicate)These past few years have been lean times in many respects — but they’ve been boom years for agonizingly dumb, pound-your-head-on-the-table economic fallacies.

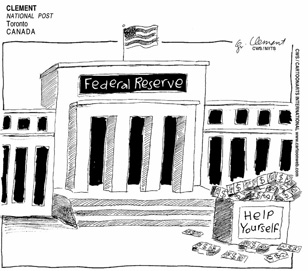

The latest fad — illustrated by a recent commentary article in The Wall Street Journal — is that expansionary monetary policy is a giveaway to banks and plutocrats generally. Indeed, that screed, titled “How the Fed Favors the 1 Percent” and written by the hedge-fund founder Mark Spitznagel, actually claims that the whole 1 versus 99 thing should really be about reining in or maybe abolishing the Federal Reserve. “The relentless expansion of credit by the Fed creates artificial disparities based on political privilege and economic power,” Mr. Spitznagel wrote.

What’s wrong with the idea that running the printing presses is a giveaway to plutocrats? Let me count the ways. First, the actual politics is utterly the reverse of what’s being claimed.

Quantitative easing isn’t being imposed on an unwitting populace by financiers and rentiers; it’s being undertaken, to the extent that it is, over howls of protest from the financial industry. I mean, where are the editorials in The Wall Street Journal demanding that the Fed raise its inflation target?

Beyond that, let’s talk about the economics.

The naïve (or deliberately misleading) version of Fed policy is the claim that Fed Chairman Ben Bernanke is “giving money” to the banks. What it actually does, of course, is buy stuff, usually short-term government debt but nowadays sometimes other stuff. It’s not a gift.

To claim that it’s effectively a gift, you have to argue that the prices the Fed is paying are artificially high, or equivalently that interest rates are being pushed artificially low. And you do in fact see assertions to that effect all the time. But if you think about it for even a minute, that claim is truly bizarre. I mean, what is the unartificial, or if you prefer, “natural” rate of interest?

As it turns out, there is actually a standard definition of the natural rate of interest, by the Swedish economist Knut Wicksell, and it’s basically defined on a P.P.E. basis (that’s for proof of the pudding is in the eating). Roughly, the natural rate of interest is the rate that would lead to stable inflation at more or less full employment. And we have low inflation with high unemployment, strongly suggesting that the natural rate of interest is below current levels, and that the key problem is the zero lower bound, which keeps us from getting there. Under these circumstances, expansionary Fed policy isn’t some kind of giveaway to the banks — it’s just an effort to give the economy what it needs.

Furthermore, Fed efforts to do this probably tend on average to hurt, not help, bankers. Banks are largely in the business of borrowing short and lending long; anything that compresses the spread between short rates and long rates is likely to be bad for their profits.

And the things the Fed is trying to do are, in fact, largely about compressing that spread, either by persuading investors that it will keep short rates at zero for a longer time or by going out and buying long-term assets.

These are actions you would expect to make bankers angry, not happy — and that’s what has actually happened.

Finally, how is expansionary monetary policy supposed to hurt the 99 percent? Think of all the people living on fixed incomes, we’re told. But who are these people? I know the picture: retirees living on the interest on their bank account and their fixed pension check — and there are no doubt some people fitting that description. But there aren’t many of them. The typical retired American these days relies largely on Social Security — which is indexed against inflation. He or she may get some interest income from bank deposits, but not much: ordinary Americans have fewer financial assets than the elite can easily imagine. And as for pensions: yes, some people have defined-benefit pension plans that aren’t indexed for inflation. But that’s a dwindling minority — and the effect of, say, 1 or 2 percent higher inflation isn’t going to be enormous even for this minority.

No, the real victims of expansionary monetary policies are the very people who the current mythology says are pushing these policies. And that, I guess, explains why we’re hearing the opposite.

It’s George Orwell’s world, and we’re just living in it.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $44,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.