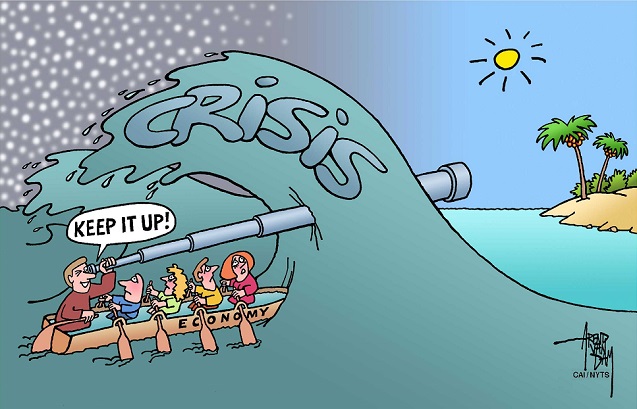

There’s an alarming amount of optimism out there about the United States’ economic prospects for 2014. Let me make the situation even more alarming by saying that I basically share that optimism. Why? Because of the Three Stooges effect: if you’ve been banging your head against a wall for no good reason, you’ll feel a lot better when you stop.

One way to describe the American economy in 2013 is to say that it was, in effect, trying to begin a strong recovery, but was held back by terrible federal fiscal policy. Housing was making a comeback; if state and local austerity policies were not going into reverse, at least they were not getting more intense; and household spending was starting to revive as debt levels came down.

But the feds were raising the payroll tax, slashing spending via the sequester, and more. Incidentally, because of these other factors, I don’t take seriously the claims of market monetarists that the failure of growth to collapse in 2013 somehow shows that fiscal policy doesn’t matter.

Austerity in the United States, although a really bad thing, wasn’t nearly as intense as what happened in Southern Europe; it was restrained enough that it could be – and, I’d argue, was – more or less offset by other developments over the course of a single year.

The point, in any case, is that the head-banging is about to stop – not in a sense that we’ll reverse our move in the wrong direction, but that we won’t keep on moving in that direction. Meanwhile, the housing market is still improving, and other stuff is relatively favorable.

None of this vindicates the multiple years of sluggish recovery that should have been vigorous. And let’s be clear: this kind of forecast is much less reliable than, say, my predictions that inflation and interest rates would stay low in the United States as long as we remained stuck in a liquidity trap, which were grounded in model fundamentals.

Still, the new year starts with some good omens. Oh, and on politics: since Obamacare is a nondisaster and Americans are facing the prospect of a decent rate of economic growth, the midterm congressional elections in November may not go the way that many conservatives currently expect.

What a Good Year Won’t Prove

A brief addendum: If 2014 is a year of relatively good growth, you know that many people will take that as somehow refuting Keynesianism – “Hey, didn’t you guys predict that the economy would never recover without fiscal stimulus?”

No, we didn’t. As I wrote in 2009: “In the long run, we will have a spontaneous economic recovery, even if all current policy initiatives fail. On the other hand, in the long run …” The fact that things eventually get better is neither a refutation of Keynesian analysis, nor a reason to excuse or overlook the vast economic and human costs of the bad policies to date – just as it does not vindicate austerity policies in Britain, either.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $43,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.