I guess I don’t quite see how Argentina’s default, of all examples, can be viewed as a cautionary tale for Greece.

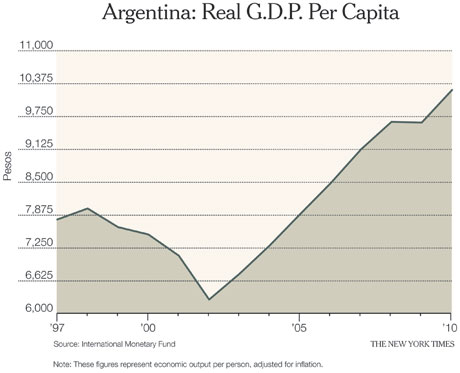

I explained in a previous column that Argentina suffered terribly from 1998 through 2001, as it tried to be orthodox and do the right thing. After it defaulted at the end of 2001, it went through a brief severe downturn, but soon began a rapid recovery that continued for a long time, as the chart on this page shows. Surely the Argentine example suggests that default is a great idea; the case against Greek default must be that this country is different (which, to be fair, is arguable).

I was really struck by a business consultant in a recent article in The Times who said that that Argentina is “no longer considered a serious country;” shouldn’t that be a Serious Country? And in Argentina, as elsewhere, being Serious was a disaster.

Not-A Does Not Imply B

Just a thought suggested by some economic discussions I’ve followed: many people seem to have a hard time accepting that there are intermediate positions — in particular that you can question free-market, hard-money dogma without being a wild man. To say that some inflation can sometimes be a good thing does not mean advocating hyperinflation; to call for deficit spending in slumps does not mean saying that debt and deficits never matter; and so on.

This inability to make distinctions has really been on display in response to my various comments about Argentina. My point is that you can’t use Argentina to make a case that default is always a disaster, since Argentina had a strong recovery after default. I would have thought that was a clear and simple point. But apparently many people believe I am claiming that:

- Everything in Argentina is wonderful to this day.

- Everything that presidents Nestor Kirchner and Cristina Fernández de Kirchner did was right.

- Default was the sole cause of good news in Argentina.

- Everyone should immediately default.

Um, no. None of those are claims that I made.

I really do worry about the state of reading comprehension. Or maybe it’s just that extremists can’t grasp the notion of non-extreme positions held by other people.

Truthout has licensed this content. It may not be reproduced by any other source and is not covered by our Creative Commons license.

Paul Krugman joined The New York Times in 1999 as a columnist on the Op-Ed page and continues as a professor of economics and international affairs at Princeton University. He was awarded the Nobel in economic science in 2008.

Mr Krugman is the author or editor of 20 books and more than 200 papers in professional journals and edited volumes, including “The Return of Depression Economics” (2008) and “The Conscience of a Liberal” (2007). Copyright 2011 The New York Times.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $31,000 in the next 48 hours. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.