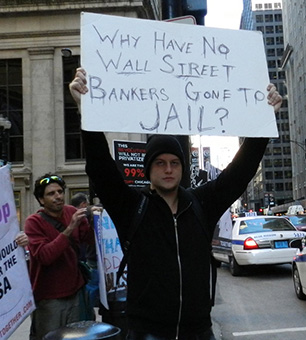

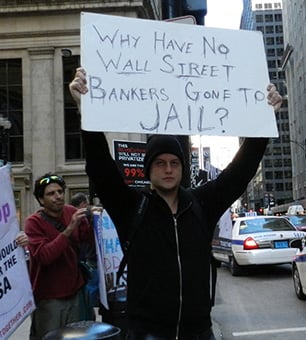

(Photo: John W. Iwanski / Flickr)This morning, in one of the largest insider trading cases in U.S. history, a federal grand jury indicted SAC Capital Advisors, a major hedge fund worth $15 billion dollars, on charges of wire fraud and securities fraud.

(Photo: John W. Iwanski / Flickr)This morning, in one of the largest insider trading cases in U.S. history, a federal grand jury indicted SAC Capital Advisors, a major hedge fund worth $15 billion dollars, on charges of wire fraud and securities fraud.

According to the indictment, from roughly 1999 to 2010, SAC Capital Advisors allegedly obtained and traded on inside information, so that the firm could make billions in illegal profits. The insider trading scheme allegedly involved a network of the hedge fund’s portfolio managers and research analysts.

The indictment alleges that SAC Capital made millions of dollars of illegal profits and avoided losses at the expense of members of the investing public.”

The indictment says that SAC Capital Advisors purposely hired portfolio managers and research analysts that had with contacts inside public companies, to essentially act as spied and get inside information on those companies.

You’d think that in an insider trading case of this magnitude, the Department of Justice would be going after the guy running SAC Capital.

After all, when the Justice Department wanted to break up the Dillinger gang, they went after John Dillinger. When they wanted to break up the John Gotti gang, they went after John Gotti. When it was obvious that Enron was conducting illegal activities, they went after Jeffrey Skilling.

While the indictment seeks criminal charges against the company, it leaves SAC Capital Advisors’ CEO, Steven A. Cohen, untouched.

But this shouldn’t come as a surprise to anyone who has followed the Obama administration’s Department of Justice’s prosecution – or lack thereof – of the big banks and Wall Street trading firms.

That’s because the DOJ only goes after the corporation, and refuses to go after the billionaire CEO’s and executives who are at the helm.

Back in December of last year, the DOJ and US Treasury officials announced that HSBC, the world’s largest bank and the second largest bank in the United State, had laundered money for some of the most notorious and murderous international drug cartels in the world, while also illegally conducting transactions on behalf of terrorists and customers in Iran, Libya, Cuba, the Sudan and Burma.

Between 2006 and 2009, according to federal officials, HSBC failed to monitor a staggering $670 billion in wire transfers and an additional $9.4 billion in cash transactions from its operations in Mexico.

And, the DOJ also said that HSBC CEO Stuart Gulliver oversaw that company as it helped launder $660 million in illegal transactions from Iran, Cuba, the Sudan, Libya and Burma by intentionally hiding the identities of these countries.

But, despite all of this, HSBC only had to sign a “deferred prosecution agreement” with the DOJ under which no criminal charges are brought against the bank or any of its banksters, provided that it meets certain conditions.

Those conditions include paying a $1.9 billion dollar fine, or less than 1% of the total amount of money that the bank helped to launder.

In other words, the bank probably even made a profit off their crime.

And, not one of the top executives at HSBC is going to see even one day of jail time.

Then there’s the case of JPMorgan’s CEO Jamie Dimon.

In multiple reports on JPMorgan’s historical multi-billion dollar trading loss, Dimon is repeatedly alleged to have criminally withheld key information from regulators about the bank’s daily losses.

And, other reports have alleged that Dimon may have actually been complicit in other criminal and/or unethical activities by JPMorganChase.

But again, while JPMorgan has been fined millions by the federal government, Jamie Dimon, the man at the helm of all the alleged criminal activity, is still sitting pretty, raking in millions of dollars, and bragging about how his bank “actually benefits from downturns” in the economy.

Now, compare the cases of SAC Capital, HSBC and JPMorgan with that of…Martha Stewart.

Back in 2004, America’s favorite home decoration guru was found guilty of conspiracy, obstruction of an agency proceeding and making false statements to federal investigators, and sentenced to five months in prison and two years of probation in relation to allegations of insider trading.

According to the Securities and Exchange Commission, Stewart avoided a loss of nearly $46,000 by selling all of her 3,928 shares of ImClone Systems stock, the day before the stock’s value fell16%.

So, why did the SEC, DOJ and the rest of the federal government relentlessly pursue the case against Stewart, who avoided a loss of just $46,000, but refuse to go after big bank CEO’s that have overseen activities that have cost the American people billions and billions of dollars?

The answer is simple: Martha Stewart wasn’t a Wall Street billionaire who had strong lobbying and financial influences over lawmakers in Washington.

Our system is so corrupt today that big bank CEO’s and Wall Street executives can do just about anything and get away with it.

Fortunately, some people have caught on to this corruption, and are trying to change it.

That’s where Sen. Elizabeth Warren comes in.

Since Warren was sworn into the Senate, she’s been kicking ass and taking names.

Using her influential seat on the Senate Banking Committee, Warren has already called out the nation’s top financial regulators for failing to take Wall Street firms and executives who broke the law to trial.

In May, Warren sent a letter to Attorney General Eric Holder, SEC Chair Mary Jo White, and Federal Reserve Chai Ben Bernanke asking them why big banks and their top executives are consistently allowed to avoid prosecution for violating federal laws.

And, she’s repeatedly gone after federal regulators in Congressional hearings for not shutting down big banks that violate the law, and throwing their CEO’s and executives in jail.

But Elizabeth Warren is only one woman, and she can only do so much.

Our system is fundamentally flawed, and it needs to be changed.

For too long now we’ve been following the Bush Administration approach to dealing with the big banks.

When the banks began to freeze and the economy began to crash, the Bush Administration had two choices.

One was taking the route that FDR took. FDR put the safety and well-being of the American people and homeowners first, and soon the economy began to improve and the banks bounced back, with regulations.

Unfortunately, the Bush Administration chose option two: Bailout the banks with 700 billion dollars in taxpayer money, have the Fed give them trillions in free lines of credit, let them get back on their feet and hope for the best. We all know how well that’s worked out.

We need to stop propping up the banks, throw crony banksters and Wall Street executives in jail, and put an end to both the administration’s “too big to fail” and “too big to jail” policies.

Enough is enough.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $44,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.