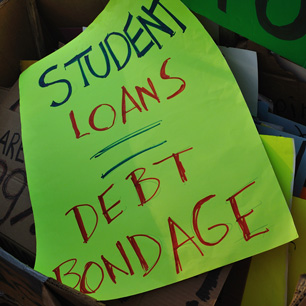

(Photo: CampusGrotto / Flickr)Last month Senator Elizabeth Warren put forward her first bill as a senator, a proposal to allow students to borrow for college at a 0.75 percent interest rate, the same rate that the Federal Reserve Board charges banks for borrowing reserves. In putting forward the bill Warren noted the rapid run up in student debt at a time when recent graduates face an especially bleak job market.

(Photo: CampusGrotto / Flickr)Last month Senator Elizabeth Warren put forward her first bill as a senator, a proposal to allow students to borrow for college at a 0.75 percent interest rate, the same rate that the Federal Reserve Board charges banks for borrowing reserves. In putting forward the bill Warren noted the rapid run up in student debt at a time when recent graduates face an especially bleak job market.

As much as I think it would be good to help struggling students, I initially did not like the proposal. As a general rule it is best for the government to be transparent in its subsidies, which means appropriating money directly from the budget.

The failure to be transparent can have large amounts of money going places where we do not especially want it to go. For example, the largest chunk of housing subsidies goes to families with incomes over $100,000 in the form of the tax deduction on mortgage interest.

It is unlikely that many politicians would stand up and argue that the rest of us should pay higher taxes so that the richest 10 percent can buy bigger homes, but that is the effect of our current housing policy. It is largely unchallenged because few people understand the implications of the mortgage interest deduction.

There are many other areas where hidden subsidies have similar effects in redistributing income upwards. One of my favorites is the implicit too big to fail insurance that we give to the country’s largest banks.

This implicit insurance allows them to borrow at below market interest rates, a subsidy that has been estimated at more than $80 billion a year by Bloomberg. This money is enriching the banks’ shareholders and top executives, some of the richest people in the country. It’s hard to imagine even Mitt Romney openly advocating an $80 billion handout for the Wall Street crew.

By tapping the Federal Reserve Board for below market loans, the Warren proposal creates the risk of yet another subsidy which could go badly awry. Depending on the conditions, we may see a lot of relatively affluent students borrowing money to invest in the stock market while completing their Stanford MBA. That one would not be a high priority for most people.

But the proposal would also have the effect of making a college education more affordable to millions of students with more limited means. Since there is not much else on the table in this respect, why not grab it?

Somehow sound economics are only important in discussions of policies that are intended to help the poor or middle class. After all, in addition to the too big to fail subsidy, our government also supports the financial industry by exempting it from the sort of sales taxes that other industries pay.

Even the IMF has written about the unfairness of the financial sector’s special tax exemption. Yet the Obama administration has not only obstructed a sales tax on financial products in the United States, the Treasury Department has done unpaid lobbying work for Goldman Sachs and J.P. Morgan to block financial taxes in Europe.

Of course the financial sector is not the only industry that gets special protection from the government. The pharmaceutical industry is able to pull in hundreds of billions of dollars a year in additional revenue as a result of government granted patent monopolies.

One of the top items on our “free trade” agenda is increasing the strength of patent and related forms of protectionism in other countries. The policy types in Washington won’t even consider a discussion of more efficient, less corrupt, mechanisms for support the development of new drugs.

And we see a similar story with the requirements of Internet intermediaries that the entertainment industry was pushing for the Stop Online Piracy Act (SOPA). After massive public outrage sent SOPA down in flames last year, the Obama administration is now trying to make everyone a copyright cop through the trade agreements it is negotiating. That’s hardly good economics or good public policy.

And, we can tell the same story with fracking. The government wants oil and gas companies to be able to pollute people’s groundwater with impunity and to enshrine this principle in trade agreements that will be blessed as “free trade.”

That is the world in which we live. So is the Warran plan the best way to help struggling students pay for the cost of higher education? Certainly not. But given the way Washington works, you take what you get, which means Senator Warren’s plan deserves support.

Not best way to do it, but what is the point of being the only honest party in the debate?

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.