As I have been writing a lot lately, the clean little secret of the global economic crisis is that standard economic theory actually performed pretty well.

It’s true that few anticipated the severity of the 2008 crisis — but that wasn’t a deep failure of theory, it was a failure of observation. We actually had a pretty good understanding of bank runs; we just failed to notice that traditional banks were a much smaller share of the system than before, and that unregulated, unguaranteed shadow banks had become so important. Once that realization hit, as the economist Gary Gorton has documented, standard bank-run theory made perfectly good sense of the story.

And the aftermath of the crisis — persistent low interest rates despite high deficits, impotence of monetary policy, major negative impacts of fiscal austerity — may not have been what most economists or government agencies predicted, but it’s what they should have predicted. As I often point out, Macroeconomics 101 has worked pretty well.

The point is that radical new theories haven’t been needed at all, since off-the-shelf economics tools we already had, provided plenty of guidance.

In that case, however, why are we doing so badly? And I mean really badly.

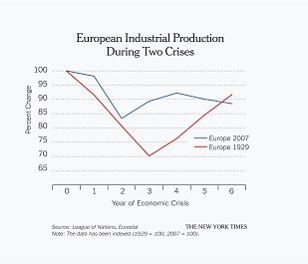

In Europe, recovery is now behind where it was at the same point during the Great Depression. See the chart on European industrial production from the League of Nations starting in 1929, and Eurostat starting in 2007.

The immediate answer is bad policy — above all, fiscal austerity in the face of mass unemployment, which is exactly what everything we know about macroeconomics says we should not be doing.

Some of these choices reflected the problems of the monetary union in Europe — but there has been a lot of austerity, even in Europe’s core nations.

And underlying it all was the absolute determination of officials to throw out everything we had learned about macroeconomic policy in depressions and go with their prejudices instead.

Of course, they found prominent economists — like Alberto Alesina, Carmen Reinhart and Kenneth Rogoff — who told them what they wanted to hear. But there were plenty of prominent economists desperately warning that they were wrong; it was the policy makers and the Very Serious People in general who decided who they would regard as serious and worth listening to — leading to what now look like comical mistakes.

But it’s no joke; it’s a terrible tale of folly and disaster.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $43,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.