Simon Wren-Lewis recently tried to show some sympathy for the devil. In a post titled “The View From Brussels” on his blog, the Oxford professor attempted to get into the mindset of European officials who defend austerity. And he got at an important point in the process, although he may have let the austerians off too lightly.

As he suggests, the crucial place to start at is why economists like himself, Brad DeLong, Martin Wolf, Larry Summers (at this point, anyway), yours truly and others are against austerity now. We’re not always against fiscal consolidation; give me the right economic circumstances and I’ll turn at least modestly deficit hawk. We are, instead, against implementing austerity when the interest rate is against the zero lower bound because the economy is in a liquidity trap, so the contractionary effects of fiscal tightening can’t be offset by monetary expansion.

So do the austerians reject this argument? No — they fail to even acknowledge that it exists. Actually, before I get there, let me offer a real-world example to illustrate what I’m talking about.

Ladies and gentlemen, allow me to present the Canadian austerity zombie.

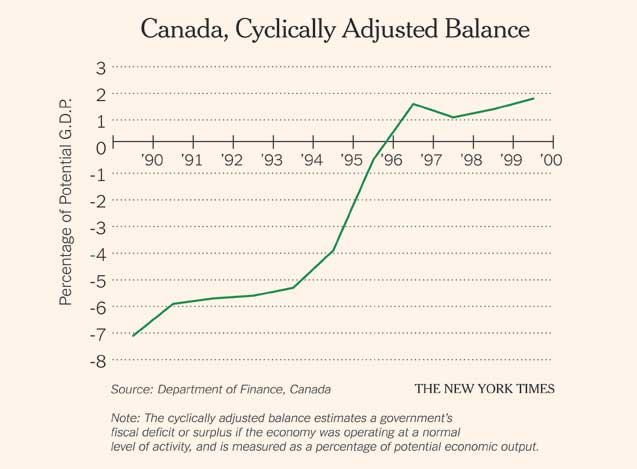

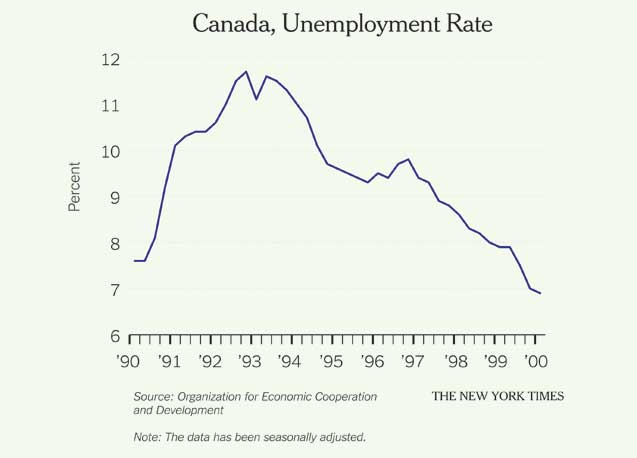

What? Or, rather, eh? Well, Canada in the 1990s keeps coming up as an alleged example of expansionary austerity. And it’s true that Canada did a lot of fiscal consolidation in the ’90s, while simultaneously experiencing a strong recovery from the decade’s early slump. See the chart on the fiscal stance estimate. And then see the chart on the unemployment rate.

Austerity roolz! Or, actually, not.

There were several special factors that affected Canada’s experience, including the Clinton boom south of the border, but the most obvious point from a macroeconomic perspective is that Canada was able to offset its fiscal contraction with a dramatic loosening of monetary policy.

This looser monetary policy both fueled domestic demand and weakened the Canadian dollar, helping exports.

The point, of course, is that right now, with policy interest rates near zero, nothing like this can happen in Europe. The contractionary effect of austerity is unmitigated. And that’s a very good reason for euro zone officials not to engage in austerity now — in fact, to provide stimulus — and wait until the aftereffects of the housing/debt bubble have worn off, and monetary policy is once again available as a counter to fiscal contraction.

So how do European Commission economists respond to this argument? Basically, not at all.

A paper titled “The Debate on Fiscal Policy in Europe: Beyond the Austerity Myth,” published by the commission last month and referred to by Mr. Wren-Lewis in his post, barely mentions monetary policy.

The question then becomes, what accounts for this blind spot, which seems even bigger in Europe than it is in the United States?

Let me venture a guess: It may have a fair bit to do with the European Central Bank’s narrow mandate. In the United States, the Federal Reserve explicitly has a dual mandate, which charges it with achieving full employment as well as price stability (this makes it natural for the Fed to consider the difference being at the zero lower bound makes). In Britain, for whatever reason, the Bank of England has proved willing to tolerate above-target inflation for a while, and the public policy debate does tend to focus on what the B.O.E. can do to offset austerity. But in Europe, the E.C.B. simply doesn’t talk about its responsibility to stabilize the real economy, nor how the liquidity trap in the European core may be compromising its ability to do so.

Nor is it just a failure to talk; let’s not forget that the E.C.B. actually raised rates in 2011, despite high unemployment, and has consistently refused to cut rates even as Europe slides deeper into double-dip recession — and ever deeper into fiscal austerity.

It’s quite a remarkable thing: we’re five years into this crisis, and key European policy makers still talk as if they were unaware of the central argument their critics have been making from day one.