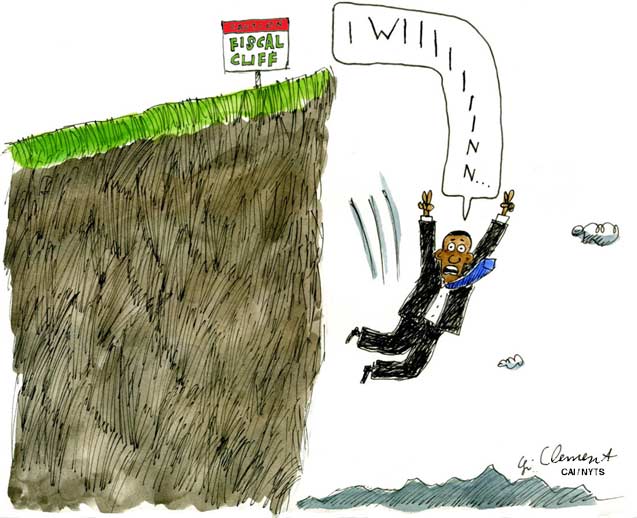

Brian Beutler of Talking Points Memo seems to have been the first to use the phrase “austerity bomb” to describe what’s scheduled to happen in the United States at the end of the year. It’s a much better term than “fiscal cliff.”

The cliff stuff makes people imagine that it’s a problem of excessive deficits when it’s actually about the risk that the deficit will be too small; also and relatedly, the fiscal cliff stuff enables a bait-and-switch in which people say “So, this means that we need to enact Bowles-Simpson and raise the retirement age!” — both of which have nothing at all to do with it.

And it can’t be emphasized enough that everyone who shrieks about the dangers of the austerity bomb is in effect acknowledging that Keynesian economists were right all along — that slashing spending and raising taxes on ordinary workers is destructive in a depressed economy, and that we should actually be doing the opposite.

Meanwhile, Europe, which has had much more austerity in aggregate than we have, is seeing grim new industrial production numbers and a worsening unemployment crisis.

By the way, some readers have asked me what is happening to Ireland, which has seen an especially sharp fall in industrial production. The answer appears, in part, to be Lipitor. That is, expiring patents on some important drugs have created a cliff for Ireland’s pharmaceutical exports. I don’t want to overstate the real impact on Irish citizens: The pharmaceuticals industry looms large in Irish gross domestic product but not so much in employment because it’s highly capital-intensive and much of the value-added accrues to foreign multinationals.

Still, not what Ireland needed. Trans-Atlantic Divergence Pursuing the theme that the United States is doing the least worst among the major economies, here’s a chart that I find illuminating. In the early stages of the crisis, unemployment rose more rapidly in the United States than in Europe. This mainly reflected differences in institutions: it’s much easier to fire people in the United States. From some point in 2010 onward, however, the situation in the United States gradually improved; initially some of the drop in unemployment was basically people leaving the labor force, but more recently there have been solid though modest gains in the ratio of employment to the relevant population (you have to adjust for aging).

Meanwhile, Europe, now formally in recession, has gotten much worse, but the truth is that it has been going downhill all along. Why the divergence? The obvious answer is that the austerity stuff broke out in 2010, and the austerians took over policy much more completely in Europe than in the United States.

Angry, shocked, overwhelmed? Take action: Support independent media.

We’ve borne witness to a chaotic first few months in Trump’s presidency.

Over the last months, each executive order has delivered shock and bewilderment — a core part of a strategy to make the right-wing turn feel inevitable and overwhelming. But, as organizer Sandra Avalos implored us to remember in Truthout last November, “Together, we are more powerful than Trump.”

Indeed, the Trump administration is pushing through executive orders, but — as we’ve reported at Truthout — many are in legal limbo and face court challenges from unions and civil rights groups. Efforts to quash anti-racist teaching and DEI programs are stalled by education faculty, staff, and students refusing to comply. And communities across the country are coming together to raise the alarm on ICE raids, inform neighbors of their civil rights, and protect each other in moving shows of solidarity.

It will be a long fight ahead. And as nonprofit movement media, Truthout plans to be there documenting and uplifting resistance.

As we undertake this life-sustaining work, we appeal for your support. We have 24 hours left in our fundraiser: Please, if you find value in what we do, join our community of sustainers by making a monthly or one-time gift.