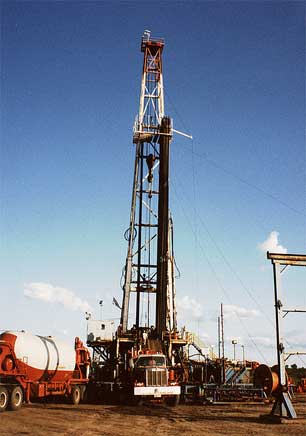

Kampala – New discoveries of natural resources in several African countries – including Ghana, Uganda, Tanzania, and Mozambique – raise an important question: Will these windfalls be a blessing that brings prosperity and hope, or a political and economic curse, as has been the case in so many countries?

On average, resource-rich countries have done even more poorly than countries without resources. They have grown more slowly, and with greater inequality – just the opposite of what one would expect. After all, taxing natural resources at high rates will not cause them to disappear, which means that countries whose major source of revenue is natural resources can use them to finance education, health care, development, and redistribution.

A large literature in economics and political science has developed to explain this “resource curse,”and civil-society groups (such as Revenue Watch and the Extractive Industries Transparency Initiative) have been established to try to counter it. Three of the curse’s economic ingredients are well known:

- Resource-rich countries tend to have strong currencies, which impede other exports;

- CommentsView/Create comment on this paragraph

- Because resource extraction often entails little job creation, unemployment rises;

- Volatile resource prices cause growth to be unstable, aided by international banks that rush in when commodity prices are high and rush out in the downturns (reflecting the time-honored principle that bankers lend only to those who do not need their money).

Read more at Project Syndicate

Copyright: Project Syndicate, 2012.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $24,000 by the end of today. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.