As we contemplate the euro mess, there’s a strong tendency to think of it as having a lot to do with the fundamental inequalities in overall productivity and economic development between euro members — backward, semideveloped countries like Greece or Portugal (not my view, but what you often hear) awkwardly tied to powerhouses like Germany.

So it comes as something of a shock to look at Eurostat data on real gross domestic product per capita (or productivity, which look similar). Sure, Greece and Portugal are relatively poor, with G.D.P. per capita of 82 and 77 percent, respectively, of the European Union average; this means roughly 76 and 71 percent of the euro zone average, since the euro countries are a bit richer than the E.U. as a whole. Meanwhile, Germany is at 120 percent of the E.U. average, or 112 percent of the euro zone average.

But it’s no different, really, than the situation in the United States. According to data from the Bureau of Economic Analysis, Alabama is at 74 percent of the average, Mississippi at 67 percent, with New England and the Middle Atlantic States at 118 and 116 percent.

In other words, as far as underlying economic inequalities are concerned, the euro zone is no worse than the United States.

The difference, mainly, is that we in the United States think of ourselves as a nation, and blithely accept fiscal measures that routinely transfer large sums to the poorer states without even thinking of it as a regional issue — in fact, the states that are effectively on the dole tend to vote Republican and imagine themselves deeply self-reliant.

The thing is, we didn’t always think of ourselves as a nation, either. Before the Civil War, people talked about “these United States”; it was only after the war that “these” became “the.”

So the key to the success of the dollar zone may be summed up in three words: William Tecumseh Sherman.

Meanwhile, in the Role Model

Early in the euro crisis, Jean-Claude Trichet, then president of the European Central Bank, knew what the Greeks had to do: “Greece has a role model and the role model is Ireland,” he told the European Parliament in March 2010.

So how’s it going? The International Monetary Fund recently released its sixth review under the Irish “extended arrangement” — I.M.F.-speak for bailout — and the fact that this is report number six tells you a lot right there. The funny/sad thing is that the Irish have been proclaimed a success story not once but twice — last fall, a year and a half after Mr. Trichet’s triumphalism, German Chancellor Angela Merkel declared Ireland an “outstanding example” and French President Nicolas Sarkozy declared the country “almost out of the crisis.”

But once again the announcements were premature.

The most interesting and depressing thing about the latest I.M.F. report is the cold water it throws on claims about the success of “internal devaluation” — the attempt to regain competitiveness with a fixed exchange rate. Last fall there was much trumpeting of a big fall in Irish unit labor costs due to rising productivity; this report more or less concedes that this was a statistical illusion, reflecting the fact that very capital-intensive industries, especially pharmaceuticals, had weathered the crisis better than labor-intensive sectors. Meanwhile, the real thing — a slight wage decline in Ireland while wages rise in Germany — has been proceeding at a relatively glacial pace. And the promised payoff in increased market share is still invisible.

Again, this is in a country that has done everything it was supposed to do.

Guess Who’s Emerging From the Crisis?

“Iceland, of course. Kitchen-sinked and cleaned-up, the Icelandic central bank has just decided to push up rates by 25 basis points to combat signs of inflation amidst ‘robust’ domestic demand,” according to a recent post in The Financial Times’ Alphaville blog.

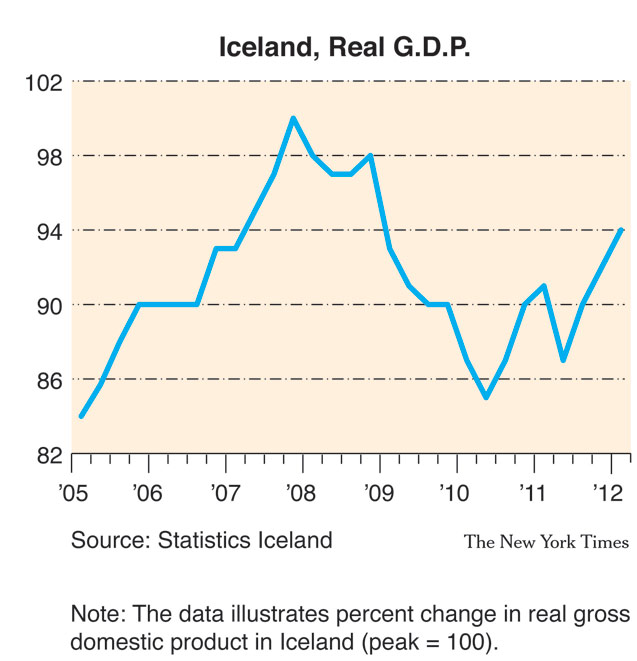

Look at the chart on this page, data from Statistics Iceland. Gross domestic product is still below previous peak, but I think one could argue — much more so than in, say, the United States — that a significant part of that peak involved a Ponzi financial sector that isn’t coming back.

I think I was one of the first outsiders to notice that Iceland’s heterodoxy was yielding a surprisingly not-so-terrible post-crisis outcome. And yes, the recovery is better than Estonia’s, and much better than Latvia’s.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $43,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.