Patriot Millionaires for Fiscal Strength, a group of citizens who make more than $1 million a year, met with politicians from both parties on Wednesday, November 16, in Washington, DC, with a unified message: Let the Bush tax cuts expire once and for all, and return the top marginal tax rate back to the Clinton-era levels.

Guy Saperstein, a former civil rights attorney and member of the Patriot Millionaires, said the most “substantive and revealing” meeting took place with supercommittee member Sen. John Kerry (D-Massachusetts). The group spent 75 minutes repeatedly and sharply telling Senator Kerry that the Bush tax cuts should expire.

“He told us a number of things that I would put in a disturbing category,” says Saperstein. “We told him the Bush tax cuts should not be restored. That's our main point. He tried to sell us on the idea of reducing the top tax rates from 35 percent down to 28 percent. He tried to make the argument that it could be made up by closing loopholes elsewhere. We were astonished by that.”

According to facts on the Patriot Millionaires' web site, letting tax cuts for the top 2 percent expire as scheduled would pay down the debt by $700 billion over the next ten years. In 1963, millionaires had a top marginal tax rate of 91 percent; in 1976, millionaires had a top marginal tax rate of 70 percent; today, millionaires have a top marginal tax rate of 35 percent. Between 1979 and 2007, incomes for the wealthiest 1 percent of Americans rose by 281 percent.

According to the National Priorities Project and Citizens for Tax Justice, the first decade of the Bush tax cuts, from 2001 to 2010, cost $955 billion; the Obama extension, from 2011 – 2012, cost $229 billion; the proposed extension, from 2013 to 2021, would cost $2.02 trillion; the total cost is $3.2 trillion.

Patriot Millionaires for Fiscal Strength isn't the only group of wealthy individuals calling for more progressive tax policies and an end to the Bush tax cuts.

Members of Responsible Wealth, a network of over 700 wealthy individuals who advocate for fair taxes and corporate accountability, recently sent a letter to members of the supercommittee. It says:

We support taxing capital gains and dividends at the same rate as ordinary income. We support progressive rates for the estate tax and a lower exemption. In addition, we support ensuring that large corporations pay their fair share by ending corporate tax loopholes and preventing use of offshore tax havens, and we support a financial transaction tax.

The idea that business owners and wealthy individuals will not invest unless marginal income tax rates and capital gains rates are low is a myth, and should not be used to justify further extensions of tax cuts for the wealthy. We invest when there is a profit to be made, not because tax rates on our profits are low. History shows that when marginal tax rates and capital gains rates were much higher than today, including the 1950s and 1960s and as recently as the 1990s, the economy was strong, investments were made, businesses thrived and millions of jobs were created. Furthermore, if the members of the committee fail to reach agreement, we do not believe the economy or investment levels will be harmed.

Like the majority of Americans, we believe that cutting Social Security, Medicare, Medicaid, unemployment insurance, education and research is completely unacceptable. We note that Social Security has no connection to our current deficit. We believe that a reduction in unnecessary military spending should be at least half of any spending cuts.

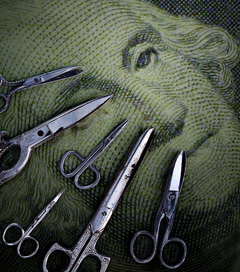

Because of the Occupy movement, these issues and facts are getting more media attention and the 99 percent are now in everyday conversations. So, who are the 1 percent?

The 1 percent bring in at least $350,000 a year and have at least $8 million in personal wealth, according to Christian Weller, senior fellow at the Center for American Progress, and associate professor in the department of Public Policy and Public Affairs at University of Massachusetts. On average, the 1 percent bring in $1 million a year in income and have $14 million in wealth. Approximately 1.5 million households are in the 1 percent.

In addition to raising awareness about tax policies, these groups also aim to counter the false “tax cuts create jobs” narrative we constantly hear in the national dialog.

“The main line that the other side has been pushing, and it's seductive, is that reductions in marginal tax rates lead to economic growth. If that were true, it would be a compelling argument. The problem is, it's not true,” says Garrett Gruener, founder of Ask.com, co-founder of venture capital firm Alta Partners and member of the Patriotic Millionaires. “Relatively modest changes in the tax code, which have had massive effects on the budget have had no effect on entrepreneurs.”

In a September 2010 Los Angeles Time op-ed called “I'm rich; tax me more,” Gruener writes:

Now that the Bush tax cuts are about to expire, Republicans are again arguing that taxes should remain low for the wealthy. The idea is that this will spur people like me to put more capital to work and start more ventures, which will create new jobs, power the economy and ultimately produce more tax revenues. It's a beguiling theory, but it's one that hasn't worked before and won't work now.

Instead, Congress should let the Bush tax cuts expire for the wealthiest Americans and use the additional tax revenues that are generated to invest in infrastructure and research. “Invest” is the right word. Putting money into infrastructure – such as roads, bridges, broadband, the smart grid and public transit – as well as carefully chosen research initiatives provides a foundation for future growth. As important, it puts funds in the hands of those who will spend them, generating demand that will pull us out of our economic crisis and toward a new cycle of growth.

No one particularly enjoys paying taxes, but one lesson we should have learned by now is that for the good of the country, we need to tax people like me more. At a minimum, we need to return to the tax rates of the Clinton era, when the economy performed far better. Simply taxing the wealthiest 2% of Americans at the same rates they were taxed before the Bush tax cuts could reduce the national deficit by $700 billion over the next 10 years. Remember, paying slightly more in personal income taxes won't change my investment choices at all, and I don't think a higher tax rate will change the investment decisions of most other high earners.”

Resource Generation, an organization for young people with wealth who are committed to social change, is also calling on Congress to let the Bush tax cuts expire. “We stand with the 99 percent,” says Burke Stansbury, a board member of Resource Generation. Stansbury inherited a little more than $1 million dollars and is expected to inherit even more. “It's all about taxes when you talk about unequal distribution of wealth in this country. The tax system has become more and more regressive.”

Resource Generation started the blog We are the 1 percent: We stand with the 99 percent. The site says, “Tax me! I support proposals to raise taxes for wealthy households like my own. No budget cuts until we raise revenue from those of us who have benefited the most and have the greatest capacity to pay.”

Anti-tax crusaders like Grover Norquist and conservative outlets like The Daily Caller say that if people like Saperstein and Stansbury want to pay more taxes, they should write a check to the Department of Treasury. That's obviously missing the larger point. Watch members of the Patriotic Millionaires respond to a Daily Caller reporter's request to have them write individual checks to the Department of Treasury.

“This is not charity,” said Saperstein in response. “Taxes are not charity. They're not voluntary. They're something society commits to do together.” Donating to the Department of Treasury individually would “have no impact whatsoever.”

Anti-tax advocates also say the government shouldn't be providing social services; leave that to nonprofits and churches. Stansbury says philanthropy isn't the solution. “A handful of people with money donating it is all well and good, but that isn't going to bring about the broad based structural change that we need in this country,” he says. “That's why standing up with a political voice and speaking as people with wealth who are in favor of higher taxes on the wealthy is a powerful way to support this movement.”

Listen to a Your Call discussion about responsible wealth and 1 percenters who support the 99 percent:

Guests:

Burke Stansbury, communications specialist for nonprofit groups, board member of Resource Generation, an organization for young people with wealth who are committed to social change

Christian Weller, senior fellow at the Center for American Progress and an associate professor in the Department of Public Policy and Public Affairs at University of Massachusetts

Garrett Gruener, founder of Ask.com, co-founder and director of the venture capital firm Alta Partners and member of Patriotic Millionaires for Fiscal Strength, an organization that is calling on President Obama to let the Bush tax cuts expire

John Harrington, president of Harrington Investments, a socially responsible investing and shareholder advocacy firm.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.