One of the driving forces behind the ongoing Occupy Wall Street protests is the fact that corporations have not been paying their fair share in taxes. A new report from Citizens for Tax Justice will no nothing to alleviate the protesters’ frustration.

CTJ looked at 280 companies, all of them members of the Fortune 500, and found that “while the federal corporate tax code ostensibly requires big corporations to pay a 35 percent corporate income tax rate, on average, the 280 corporations in our study paid only about half that amount.” And those who paid even half the statutory corporate tax rate paid far more than many of their competitors.

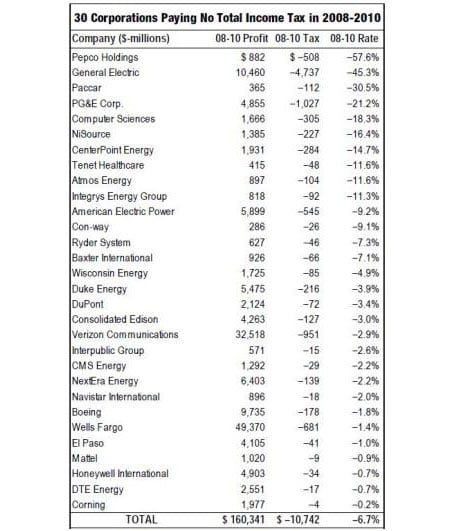

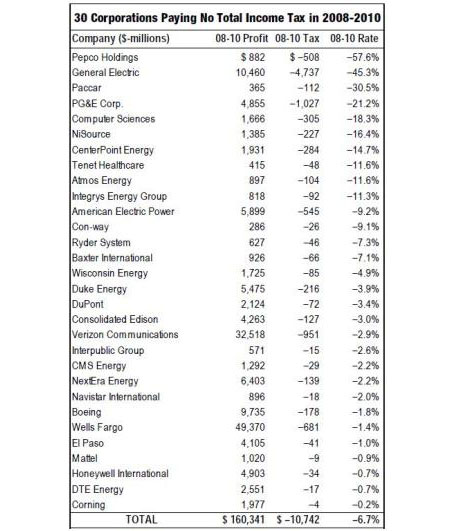

In fact, in the last three years, 78 corporations had at least one year where they paid no federal income tax at all, while 30 corporations paid not a dime over the entire three years. Those 30 corporations paid nothing, even though they made $160 billion in profits over that period:

– Seventy-eight of the 280 companies paid zero or less in federal income taxes in at least one year from 2008 to 2010…In the years they paid no income tax, these companies earned $156 billion in pretax U.S. profits. But instead of paying $55 billion in income taxes as the 35 percent corporate tax rate seems to require, these companies generated so many excess tax breaks that they reported negative taxes (often receiving outright tax rebate checks from the U.S. Treasury), totaling $21.8 billion. These companies’ “negative tax rates” mean that they made more after taxes than before taxes in those no-tax years.

– Thirty corporations paid less than nothing in aggregate federal income taxes over the entire 2008-10 period. These companies, whose pretax U.S. profits totaled $160 billion over the three years, included: Pepco Holdings (–57.6% tax rate), General Electric (–45.3%), DuPont (–3.4%), Verizon (–2.9%), Boeing (–1.8%), Wells Fargo (–1.4%) and Honeywell (–0.7%).

As CTJ’s report put it, “just as workers pay their fair share of taxes on their earnings, so should successful businesses pay their fair share on their success. But today corporate tax loopholes are so out of control that most Americans can rightfully complain, ‘I pay more federal income taxes than General Electric, Boeing, DuPont, Wells Fargo, Verizon, etc., etc., all put together.’ That’s an unacceptable situation.” And its one that lawmakers could fix, if they were willing to stand up to the nation’s biggest corporations.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $50,000 in the next 9 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.