It is no exaggeration to say that the rich, obscenely, would get richer directly on the backs of the poor(er) getting poorer under the Romney/Ryan tax proposal. So why would anyone not a member of the top 2 percent sign up for this?

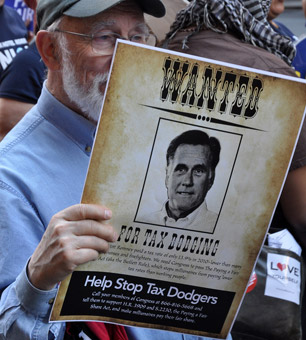

Rates of taxation have long been central to US politics. It has become increasingly popular for Republicans, including presidential nominee Mitt Romney, to disparage taxation.

It is “American,” Romney has declared, to avoid paying any taxes. Paying taxes has devolved from a central social responsibility to a game of creative work-arounds. Today, taxes are not so much the common contribution to cover the costs of social benefits and infrastructure relative to one’s means, as they are a burden to be avoided.

Do you support Truthout’s reporting and analysis? Click here to help fund it this week!

“Everyone” now agrees that the wealthy together pay a significantly larger proportion of total taxes in the US than the poor. Republicans charge that the bottom 50 percent of income earners “pay no tax at all.”

This is at the very least misleading, at worst false – for though they may pay no federal income tax, wage-earners certainly contribute payroll taxes and Social Security withholdings; they pay local, state and municipal taxes; they are liable for the same sales tax rates on any purchases as higher income earners, and so on.

In this, the bottom half of Americans may differ from Romney himself simply in paying no investment profit tax, only because unlike him, they are in no position to have any investment profits.

Now the claim that the top 1 percent of income earners together pay 27 percent of the total of total federal taxes, while their share of income is 18 percent (doubling over the past 30 years ago) is invoked repeatedly by apologists to signal the unfair burden of the current tax structure on the really wealthy.

Romney-Ryan Republicans emphasize this claim largely to counter the observation that most really wealthy individuals pay a much lower personal income tax rate than those significantly less wealthy than they, from the poor through the middle class. Income of the wealthy derives overwhelmingly from investment returns, rather than from wages, which is taxed in the US at a considerably lower rate than comparable levels of wage and salary income.

Republican rhetoricians mislead here in two related ways:

First, as they disparage discussion of class considerations when critics contrast the benefits to the 1 percent at the expense of the rest of us, Republicans readily invoke class to indicate how much of the tax burden “they” bear. Quick to condemn what they call “class warfare” when they are the objects of such criticism, they nevertheless are the first to claim class “solidarity” to decry their total collective contribution to taxes.

But, second, no individual ends up paying the bulk of US taxes. Individuals pay specific rates. The same goes for corporations: “Corporations are people too, my friend.” But so then are social classes.

That a very small group ends up paying the bulk of total income taxes in America today is a function of the fact that this group of individuals (not just corporations) has become so ridiculously wealthy.

The top 1 percent in America own more than one-third of the nation’s wealth, while the bottom half owns just 1 percent. Staggeringly, 20 percent command 93 percent of nation’s wealth. It is especially revealing, isn’t it, that though almost all the top-earning individuals are now paying something like a third or less of the tax rate that those in their bracket paid in the 1950s, they pay a considerably larger proportion of the total taxes collected than those historical peers.

When Republicans insist that the tax burden should be more widely spread, it is the fact of this dramatically expanded wealth gap that should give pause.

Rationalizers for the really rich want it both ways. They complain about their collective tax burden and being the targets of class warfare. Yet they ignore the dramatically expanded income and wealth differentials when looking to invoke their own class burden.

Fifteen percent of, say, $30 million in income may add up to a great deal of money. No one should be misled by this, however. Mitt Romney, no doubt, would far rather be left with his $20 million plus after taxes if his rate were 30 percent, than he would if he were only paying say a 15 percent rate on an annual income of “just” $100,000. It’s not just the tax rate, stupid.

It’s not that tax rates are irrelevant, of course. Far from it. Under vice-presidential candidate Paul Ryan’s proposed budget, those earning more than $250,000 would see their rates drop by about 11 percent, the more so as incomes rise.

Ryan, reporting family income this year of about $350,000, would pay a couple of thousand less in tax on his own proposal. The likes of Romney would make a killing, however, and see their tax rate drop to less than 1 percent. Those earning less than $250,000, by contrast, would face rising taxes by as much as a couple of thousand dollars. It is no exaggeration to say that the rich, obscenely, would get richer directly on the backs of the poor(er) getting poorer.

Romney is likely to object that he and those like him are losing income rightfully their own to the state (Well, you would think this applies to those less well off too). This suggests the underlying rationale behind Republican tax philosophy today. That income, they insist, is mine, not the state’s; the state takes it from me only under duress.

In the extreme, taxes for Grover Norquist Republicans are a form of collective coercion, if not theft. Here, too, the tax rate is more or less irrelevant: Any tax is considered a state grab. The state has no right to what is properly mine, no matter – as President Obama famously has pointed out – that I likely would not have had the opportunity to have accumulated so much but for the state being structured to enable me to do so, and that it has provided the infrastructure without which this accumulation would not have been possible.

Others helped pay for this infrastructure that no individual, no matter his wealth, could cover on his own. That the tax rate of Romney’s father’s generation was something like three times the rate Romney today admits to paying helped put in place the infrastructure that would allow the son to ratchet up the already considerable wealth of his father.

Obviously, Mitt is committed to refusing to provide the same generative conditions for future generations that he enjoyed coming up.

A quick thought experiment indicates how widespread, and hypocritical, this line of accounting is. What proportion of the 435 members of the US House of Representatives, and notably the 242 Republican members, have benefitted personally from publicly funded education? It will likely surprise everyone – perhaps other Republicans more than anyone – that (on pretty narrow criteria) more than three-quarters of Republican Representatives have some, often significant history of publicly funded education in their biographies.

Ryan is not atypical. Far more House Democrats show at least some education at elite private universities than do Republicans. Those Republicans educated at elite private institutions tend to be the very small number of Republican Congresswomen, along with some of the lawyers. Often from modest working or middle class families, House Republicans characteristically moved from their local public school system, sometimes through community college, to a state university, working their way into successful small business careers of one sort or another, into law practices or occasionally medical careers.

Most Republican representatives, in short, seek to deny the sorts of benefits they received at public behest from being publicly provided to younger generations coming up today. And they do so not because America can no longer afford to continue financing public education; they do so because they insist on diminishing tax rates for the class of individuals most in a position to pay them. A significant ground of their own success in life is being withdrawn as an option for others. Since 2009, as attacks on taxation have ratcheted up, more than 300,000 public school teachers have lost their jobs, and any number of schools have responded to budget cuts by restricting the school week to just four days.

While Mitt Romney’s schooling was exceptional by comparison, having attended only private elite schools and universities, his running mate, Ryan’s, like Speaker John Boehner’s, is exemplary.

Ryan graduated from public school in his hometown, Janesville, Wisconsin, and attended Miami University of Ohio, a public institution, for his undergraduate university degree in economics and politics. Boehner graduated from a public high school before attending a Catholic university. Neither went to graduate school.

And yet the infamous Ryan budget, which Romney characterizes as “practically identical” to his own, seeks to cut about 15 percent from federal K-12 funding, would slash Pell grants on which most low-income students depend to go to college and, as Ezra Klein has calculated, would reduce overall funding for “education, training, employment and social services” – all of which disproportionately impact those at the lower ends of the income scale – by as much as one third in the next ten years.

It is more than ironic, then, that Romney, Ryan and their representative spokespeople repeatedly stress that only they can “save America.” Curiously, a Mormon and a Catholic – not that long ago, pariah denominations in American Christianity – now invoke the messianic rhetoric of evangelical Christianity. In seeking to “save “America, they stand as the ultimate saviors of America’s 1-to-2 percent from the heterogeneous hordes it has been Obama’s promise to represent.

And this salvation of the economically sanctified is done on the backs of those in much greater distress than they – the very people Republicans now are committed to casting adrift.

Why would anyone not a member of – or close to – the top 2 percent sign up for conversion to this conviction? In undergraduate course discussions about principles of distributive justice, I have invariably found students mostly supporting a flat tax rate over a progressive one, despite the fact that they would have little if any chance of joining the top 2 percent.

That they hold out the somewhat irrational hope they may rise into the 2 percent seems to suffice against (or obscure) their own more compelling standing interests. Future possibility, no matter the remoteness, apparently trumps lifelong class standing not only in the here and now, but as the most probable prospect they face.

Republicans understand the compulsive make-believe of this “flat earth” psyche, not least because they have been instrumental in shaping and reinforcing “classless” America as the heavenly city shining atop the hill.

In “Cosmopolis,” Don de Lillo’s prescient novel about the end(s) of the world prompted by this Republican sort of (re)vision, Vija Kinski is the young billionaire financier’s “chief of theory.” Short on wisdom, every billionaire needs a sage to make sense of the world, to prognosticate and predict.

Kinski insists that money has become completely self-referential, speaking only to itself, sucking everything else into its terms of reference. For tax-less Republicans, even health, illness, life and death have ceased to be meaningful in their own terms. Their significance is calculable in terms of what they can be traded for, their rate of exchange, their exchange value.

Politics, by implication, has become class war by tax policy. Society has been de-realized – the world outside the billionaire’s limo is devolving into anarchic chaos – fulfilling the prophecy of Margaret Thatcher three decades ago, that there is no such thing as society.

Time, here – past and future – has become just another “corporate asset, to be bundled in credit default swaps or ticketed memorializations.” The billionaire’s success thrives on “ill will towards others” – backing down, apologizing, is not an option. It would be “not authentic,” other people’s terms.

Learning to read, write, and reason will be reserved only for those capable of covering the costs themselves or willing to bear large loans with no guarantee of a job awaiting them to afford the interest payments once graduated.

Romney’s perceived inauthenticity flows from this drive to fabricate, to make up and make believe whenever ideas fail him or he is confronted by a contradictory commitment while pandering to a different electorate from some previous campaign, or in another part of the country. As the indecisive Decider, he needs to look as though he is in complete command, so as not to lose face, even when the consequences of his (policy) choices are so self-evidently disastrous. The cipher candidate is the perfect cut-out for a projected world so discounted of human significance.

If this is the near future to which anyone aspires, Mitt Romney is their man. Buyers cannot say they had no idea.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $44,000 in the next 6 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.