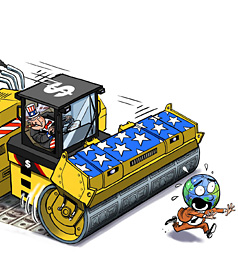

I am a bit shocked that so many people around the world are comparing the United States Federal Reserve’s quantitative easing program to China’s currency manipulation.

While America’s policy may annoy its trading partners, they are not the target. China’s policy, on the other hand, is predatory, pure and simple. There is no equivalence.

But that doesn’t matter, since everybody hates quantitative easing. Inflationistas in the West believe that it will bring about the end of civilization, while the rest of the world is simply furious about the Fed’s actions.

What we are really witnessing is a worldwide inability to think clearly about economics. In particular, the unconventional nature of the current economic situation is revealing how many people rely not on any model of how the economy works, but rather on what the late economist Paul Samuelson called “shibboleths” — by which he meant slogans that take the place of hard thinking.

The underlying problem afflicting the global economy is simple: we have too much savings and not enough investment.

How did this happen?

The answer, mainly, is that past overborrowing in the West has left large parts of the world credit-constrained, and now forced to deleverage by cutting spending. And even a zero interest rate isn’t sufficiently alarming to persuade nations that are still unconstrained to increase their spending by enough to offset these cuts.

So what can monetary policy do?

1. It can try to achieve negative real interest rates by creating expectations of future inflation.

2. Alternatively, governments can step in and spend since the private sector won’t.

3. Finally, central banks can try to buy long-term debt. The point here is while we face zero interest rates in the short term, it’s possible, though not certain, that you can get at least some traction by buying those longer-term bonds.

But now that we’re in this mess, Very Serious People around the world are objecting to all three possible actions.

Inflation targets are horrible because we must have price stability; fiscal policy is unacceptable because we must have balanced budgets; quantitative easing is outrageous because that’s not what central banks are supposed to do.

Notice that every objection is based on a shibboleth.

Price stability is treated as an absolute virtue, without any model that explains why. The same with budget balance.

And those who are horrified at the idea of expansionary monetary policy have been inventing concepts on the fly to justify their position.

My question for the Very Serious People is this: if deficit spending is unacceptable, then what is your proposal for closing the gap? Must tens of millions of workers remain jobless so that you can feel comfortably orthodox?

The usual reply involves denying that we have excess savings. That’s very much like the denial of climate change in the United States: because conservatives find the implications uncomfortable — that we need government intervention to deal with the situation — they prefer to deny the facts.

But we do, in fact, face a problem of inadequate demand.

And it would be deeply unreasonable, and deeply irresponsible, for people to continue to cling to simplistic slogans and fail to act.

BACKSTORY: Obama On Defense

Upon his arrival at the Group of 20 summit in South Korea on Nov. 11, President Barack Obama of the United States found himself in the unusual position of having to defend the actions of the Federal Reserve back home.

Just a week before, the Fed had announced plans to buy $600 billion in Treasury bonds in a virtually unprecedented attempt to lower long-term interest rates. The injection of cash into the United States’s economy via this unconventional route follows the failure of traditional monetary policy interventions to revive the sputtering economy.

However, a possible side effect of this policy could be a depressed exchange rate for the dollar abroad, which has drawn intense criticism from foreign governments, especially those of developing nations.

Officials representing Brazil, South Africa and China, among other countries, pointed out that if the value of the dollar were to drop, their nations might see their economic growth undermined by competition from cheaper American exports.

The criticism made it harder for Mr. Obama to push for change with regard to China’s monetary policy, which American officials contend has kept China’s currency artificially low and cost many jobs in the United States.

By the close of the summit, the debates over currencies and budget deficits had become fraught, but representatives of the world’s 20 largest economies were able to agree on a plan of action: the International Monetary Fund will analyze economic imbalances among the various nations and report back in a year.

Stateside, critics of the Fed’s action have been less conciliatory. In an open letter to Ben S. Bernanke, the Fed chairman, 23 economists and political thinkers called on Nov. 15 for a halt to the bond purchases, arguing that the risks of currency debasement and inflation could undermine employment efforts in the United States.

© 2010 The New York Times Company

Truthout has licensed this content. It may not be reproduced by any other source and is not covered by our Creative Commons license.

Paul Krugman joined The New York Times in 1999 as a columnist on the Op-Ed page and continues as a professor of economics and international affairs at Princeton University. He was awarded the Nobel in economic science in 2008.

Mr Krugman is the author or editor of 20 books and more than 200 papers in professional journals and edited volumes, including “The Return of Depression Economics” (2008) and “The Conscience of a Liberal” (2007).

Copyright 2010 The New York Times.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $33,000 in the next 2 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.