Washington is inundated with deficit commissions. The country has piled up a huge debt because we cut taxes for the wealthy and borrowed to make up the difference. But everyone says we can’t fix the problem by raising taxes on the rich in a recession because taxes “take money out of the economy.” Is there a factual basis for this idea, or is it just one more corporate/conservative-generated piece of “conventional wisdom” bamboozlement?

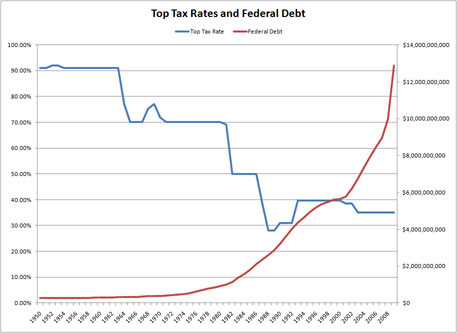

A brief budget history since the 80’s: We cut taxes, increased military spending and cut investment in our infrastructure, and the result was huge budget deficits and slower economic growth. Then in the 90’s we raised taxes on the rich and increased investment in the country and we had big budget surpluses and the economy was growing at a good clip. Then in the 00’s we again cut taxes on the rich and raised military spending and cut back on investing in the country, and went back to huge deficits (“incredibly positive news“) and feeble economic growth culminating in the financial crash.

So now, to address the Reagan/Bush deficits the DC elites — the “serious people” — are proposing … wait for it … not raising taxes on the rich, not cutting military spending and not investing in the country. Instead they want to cut back more on the safety net and on services for the middle class. There really is a brain disease loose in DC.

The justification for DC’s refusal to fix a problem caused by tax cuts on the rich by restoring taxes on the rich is that you can’t raise taxes on the rich during a recession. The oft-repeated idea that taxes “take money out of the economy” has become so ingrained that there is no discussion at all, it is just accepted as a given. It is “conventional wisdom.” It certainly is a convenient conventional wisdom for the wealthy, but it is a fact?

Let’s look at some counter-arguments.

1) Tax cuts for the rich means borrowing. This is the root of the “taxes take money out of the economy” argument because the resulting borrowing pumps into the economy, which is stimulative. If you stop the borrowing the resulting stimulus is withdrawn. Of course, tax cuts are the least-effective stimulus, especially when it is top tax rates we are talking about, but still… Unfortunately we have been borrowing a lot for a long time to pay for tax cuts at the top, so massive debt has accumulated and the interest paid (guess who it is paid to) on the borrowing is significant and anti-stimulative. (Don’t interest payments “take money out of the economy?”)

Apparently none of the gaggle of deficit commissions have seen this chart:

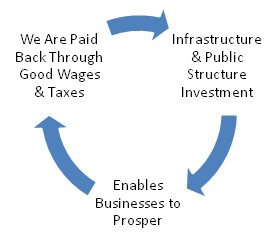

2) Taxes bring in revenue to pay for improvements in infrastructure that cause the economy to grow. Investing in modern transit systems, smart grid, energy efficiency, fast internet and other improvements leads to a huge payoff. Infrastructure improvement and maintenance is the “seed corn” of economic growth. We have been eating that seed corn since Reagan’s tax cuts. Some might argue that we can just borrow to invest in infrastructure — but we don’t. One result of the Reagan tax cuts was a cutback in infrastructure investment, which is dissed as “government spending.” (For some reason the same borrowing to spend on tax cuts is not dissed.) After 30 years of Reaganomics our infrastructure has fallen behind and we are not competitive in the world economy.

Taxes also bring in revenue for improving our schools, colleges and universities. Not only does this help our economic competitiveness, education improves each of our lives and our level of happiness. (And more education helps people who end up on deficit commissions to understand that tax cuts for the rich cause deficits which can be fixed by putting top tax rates back where they were before the deficits that they caused.)

This was supposed to be the deal: We invest in infrastructure and public structures that create the conditions for enterprise to form and prosper. We prepare the ground for business to thrive. When enterprise prospers we share the bounty, with good wages and benefits for the people who work in the businesses and taxes that provide for the general welfare and for reinvestment in the infrastructure and public structures that keep the system going. The social contract, a beneficial cycle:

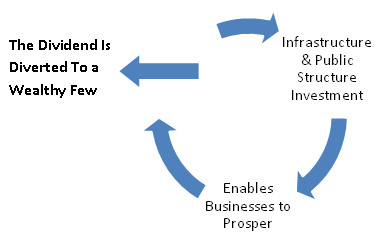

The tax cuts broke that contract and diverted the money intended for society’s use to an already-wealthy few at the top. Since Reagan the system is working like this:

Since the Reagan Revolution with its tax cuts for the rich, its anti-government policies, and its deregulation of the big corporations our democracy is increasingly defunded (and that was the plan), infrastructure is crumbling, our schools are falling behind, factories and supply chains are being dismantled, those still at work are working longer hours for fewer benefits and falling wages, our pensions are gone, wealth and income are increasing concentrating at the very top, our country is declining.

3) Taxes on the rich redistribute money back into the economy. This gives more people more money to spend, which helps a consumer-driven economy to grow.

We have seen our country’s wealth and income concentrate into fewer and fewer hands since the Reagan tax cuts:

The chart shows the share of the richest 10 percent of the American population in total income – an indicator that closely tracks many other measures of economic inequality – over the past 90 years, as estimated by the economists Thomas Piketty and Emmanuel Saez.

Timothy Noah wrote about inequality in a recent Slate piece, The United States of Inequality (Note, see Slate’s Visual Guide to Income Inequality)

Today, the richest 1 percent account for 24 percent of the nation’s income. … from 1980 to 2005, more than 80 percent of total increase in Americans’ income went to the top 1 percent.

Currently a few people receive most of the income and own most of everything. A very high top tax rate reduces this concentration of wealth.

4) Historically, high tax rates are associated with increased economic growth. It is others to say whether this correlation is causation, but cutting taxes has certainly not been associated with increasing growth.

Along with that chart, look at this chart of growth since the 80s tax cuts: (12-quarter rolling average nominal GDP growth.)

Conclusion: Raising taxes on the rich will not slow the economy. In fact, every indication is that tax cuts on the rich might hurt the economy. So the real question is, why aren’t these “deficit commissions” proposing that we fix a deficit problem that was caused by tax cuts for the rich by raising taxes on the rich back to where they were before the problem? It is clearly time to stop the “riverboat gamble” and restore pre-Reagan top tax rates.

P.S. Alan Grayson has suggestions for ways the rich can use their $83,347 average tax cut:

Update – After posting I came across this from David Leonhart in today’s NYTimes, Were the Bush Tax Cuts Good for Growth?

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7.

Exactly. Leonhart says the right’s case is a strong one, “When people are allowed to keep more of each dollar they earn, they are likely to work longer and harder.” Actually, you would think people who were taking home a bit less would work longer and harder to make up the difference, wouldn’t you? The Ayn Randian idea that people stop working if they have to pay taxes might apply to the very, very, very (very) rich, but the rest of us have to pay the bills.

And so does our democracy. Anyway, you can solve the conflict by looking at what actually happens, which he did, and what happens is that tax cuts and a slow economy go together every time.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $48,000 in the next 8 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.